MACRO CONTEXT

A Province Positioned for Growth.

Alberta’s strong population growth, resilient rent gains, investor-friendly yields, and inflation-hedging real assets combine to make it one of Canada’s most compelling multifamily markets.

Population Growth.

Alberta continues to lead the nation in net migration, adding residents and workers at a pace that supports sustained demand for rental housing.

Affordability Advantage.

Compared with major markets like Vancouver and Toronto, Alberta offers significantly more attainable home prices and rents — supporting long-term tenant stability.

Economic Strength.

Growth in technology, logistics, transportation, energy, and healthcare is helping diversify Alberta’s economy and build durable employment.

Sources: Canada Mortgage and Housing Corporation (CMHC), Statistics Canada, Colliers Canada (Cap-Rate Benchmark).

Market Fundamentals — Alberta Multifamily.

Alberta’s population growth, resilient rent increases, and investor-friendly yields have created one of Canada’s strongest multifamily markets.

Momentum that Outpaces the Nation.

Alberta’s rents have outperformed every other Prairie province, with multiple years of consecutive gains driven by migration-led demand.

Returns that Reward Risk and Value.

Cap rates near 5% offer more attractive yields than comparable assets in Ontario and British Columbia, while stable incomes support cash flow durability.

Demand that Outruns New Supply.

Despite new construction, vacancy remains low in major Alberta markets, reflecting strong, sustained demand for quality rental housing.

Sources: Canada Mortgage and Housing Corporation (CMHC), Statistics Canada, Colliers Canada (Cap-Rate Benchmark).

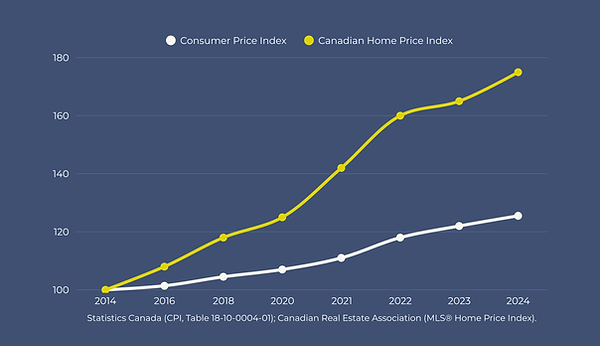

Real Assets Outperform Inflation

Inflation Rewards Ownership.

Real assets have historically outperformed inflation, creating a powerful opportunity to protect purchasing power and build wealth through multifamily investment.

-

Inflation is persistent. Prices for goods, wages, and housing continue to trend higher across Canada.

-

Borrowing costs are easing. Expected rate cuts should improve acquisition leverage and support transaction activity.

-

Real assets hedge inflation. Multifamily assets can help preserve purchasing power and generate income in a variety of cycles.

-

MetroLiving is positioned. A robust acquisition pipeline is aligned to capitalize on macro tailwinds in Alberta multifamily.

Inflation is not slowing us down — it is giving us leverage.

The MetroLiving Advantage.

Our approach is rooted in long-term thinking, operational excellence, and rigorous underwriting. We focus on markets and assets that can withstand economic cycles and deliver stable performance.

Alberta-Only Focus

A focused strategy built around Canada’s strongest and most resilient rental markets.

High-Quality, Well-Located Assets

Properties selected for durable income streams, strong tenant demand, and long-term appreciation potential.

Institutional-Grade Underwriting

Rigorous underwriting and conservative assumptions guide our investment decisions.

Active Portfolio Management

A hands-on approach centred on tenant experience, operational efficiency, and unlocking value.

CMHC-Backed, Long-Term Financing

Favourable leverage, low interest rates, and enhanced stability through long-term insured debt.

Transparent Reporting & Strong Governance

Clear communication, consistent reporting, and aligned leadership built on accountability.c

INVESTMENT THESIS

Our Investment Formula

Strong Market

Quality Multifamily Assets

Conservative Financing

Active Management

Stable Income & Long-Term Growth