Why Alberta Is Outperforming Canada’s Rental Market — And What It Means for Investors

- Calley Erickson Team

- Dec 30, 2025

- 2 min read

Alberta has become one of the strongest and most investable rental markets in Canada. The drivers behind this shift are structural — not temporary — and they are reshaping the long-term opportunities for multifamily investors.

Let's break down the three forces powering Alberta’s outperformance, why they matter, and how MetroLiving REIT is positioning capital to benefit.

Alberta Leads Canada in Population Growth

Alberta’s population growth is at multi-year highs, driven by:

Interprovincial migration from Ontario and BC

International immigration outpacing supply growth

Economic momentum across tech, logistics, energy, trades, and services

The key insight: People follow affordability and opportunity — and both are strongest in Alberta.

When population grows faster than housing supply, rental demand rises.

Alberta Rent Growth Is Outpacing the National Average

Rents in Calgary have been rising faster than many major cities in Canada.

Why?

A growing population

Lower household ownership rates among newcomers

Limited new rental supply

A large cohort of renters by choice

For investors, this means: Income growth + stronger asset values.

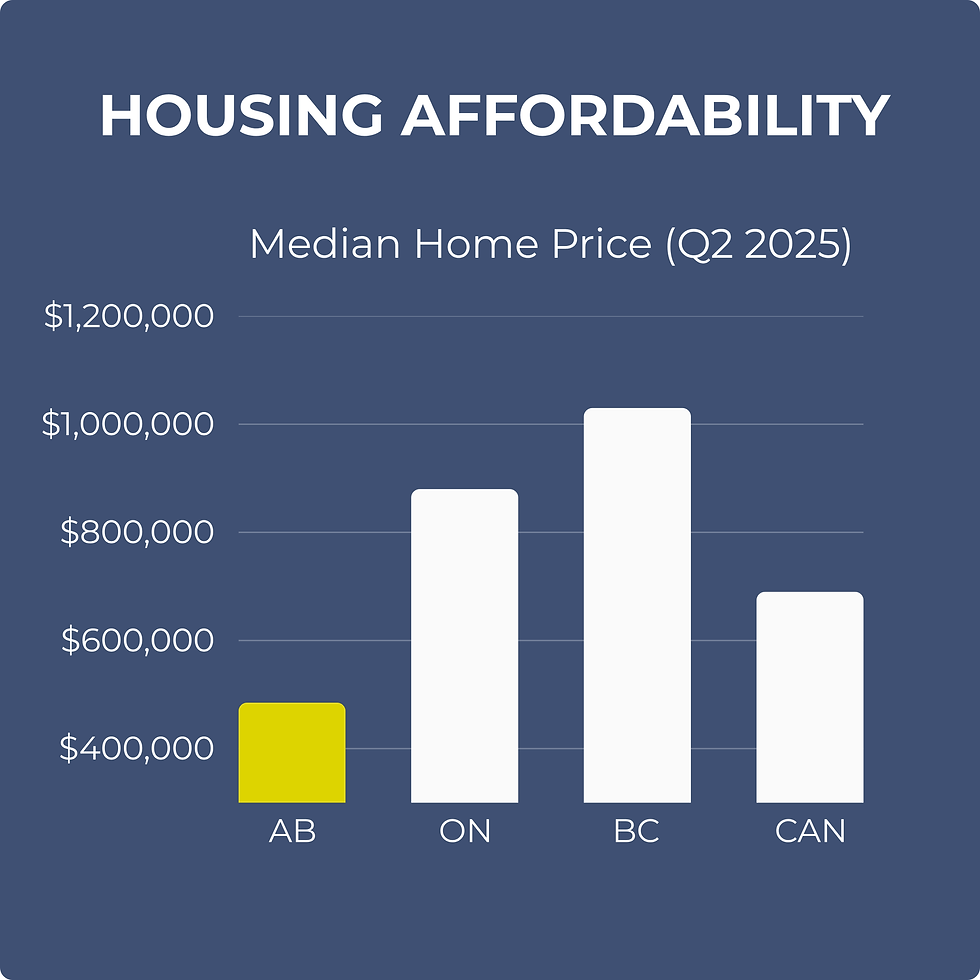

Alberta Is the Most Affordable Major Housing Market in the Country

This is the quiet engine behind Alberta’s outperformance.

Ontario and BC renters are burdened by high housing costs. Alberta renters spend less on housing, less on debt, and have more disposable income — which stabilizes the entire rental ecosystem.

For assets, this means:

Lower delinquencies

Stronger occupancy

Room for rent growth

Longer tenant tenures

More resilient cash flow

What This Means for Investors

Three factors — migration, rent growth, and affordability — create a tailwind that is rare in Canadian real estate cycles.

Investors benefit from:

Stronger NOI growth

Higher stabilized values

Lower vacancy volatility

Better long-term return potential

This is why MetroLiving focuses exclusively on Alberta multifamily. The fundamentals simply outperform the rest of the country.

How MetroLiving Is Positioned

Alberta-only acquisition strategy

Conservative underwriting

CMHC-insured long-term debt

Operational excellence

Focus on tenant experience and sustainable value creation

This is not speculation. It is a strategic, fundamentals-first approach.

The Window Is Open

Alberta is early in its cycle — and early investors tend to capture the strongest gains.

Request the Investor Deck

Get the full analysis behind MetroLiving’s strategy, asset selection, underwriting, and performance outlook.

Calley Erickson